King Baudouin Foundation's Giving Circle Izindlovu

Gifts that give Tax Reduction in Belgium, France, the Netherlands, Luxembourg and Denmark

The King Baudouin Foundation collaborates with our Izindlovu Giving Circle project which is committed to help preserve and raise awareness on wildlife conservation.

Donations of 40€ or more per year to the Foundation’s account benefit from a tax reduction of 45% of the amount actually paid (art. 145/33 CIR).

Tax reduction certificates are available for individuals and companies in following countries:

Belgium, France, the Netherlands, the Grand Duchy of Luxembourg and Denmark.

To receive Tax Reduction donate to the Giving Circle Izindlovu account, managed by the King Baudouin Foundation by clicking on button wibelow or above or wire on account number of the King Baudouin Foundation:

BE10 0000 0000 0404

BIC: BPOTBEB1

mentioning “623/3707/20066” – Attention: structured message!

The account and the tax certificates are managed by the King Baudouin Foundation and will be send by the Foundation in the month of February of the year following your gift.

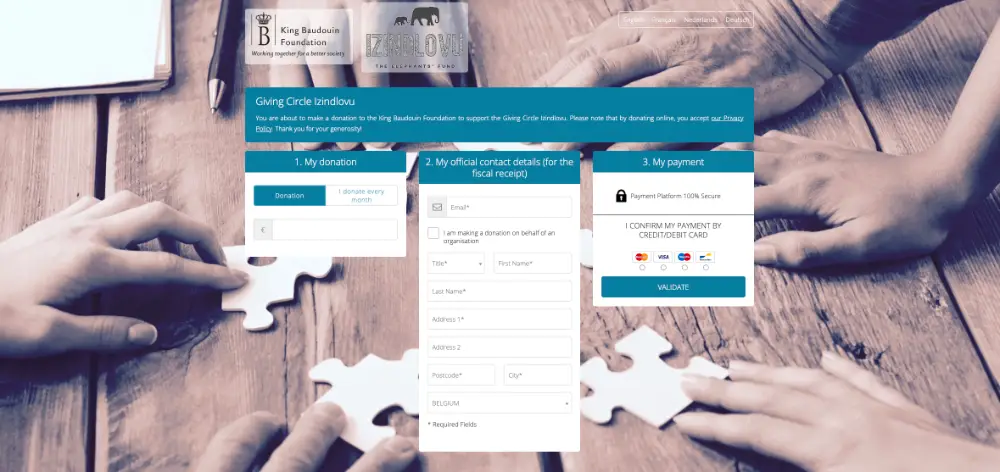

You can also make a donation online by clicking on button here below and hereby visiting our Giving Circle Izindlovu page where you can pay with mastercard, visa, maestro and bancontact.

You can also make a donation online by clicking on button here below and hereby visiting our Giving Circle Izindlovu page where you can pay with mastercard, visa, maestro and bancontact.

Gifts that give Tax Deduction in Germany

To benefit from the Tax Deduction in Germany, please contact us as we can provide tax certficates through a partner in Germany.

For companies in Belgium

To benefit from the tax deduction in Belgium, companies must have sufficient taxable profit within the business or corporation. The donation can only be deducted from the profit of the current financial year and cannot be carried forward as a loss to a future year.

Additionally, the total amount of tax-deductible donations may not exceed 5% of the company’s total taxable income, with an absolute maximum deduction of €500,000.